Battery Magic

- David Galland

- Sep 17, 2025

- 39 min read

By David Galland

“Any sufficiently advanced technology is indistinguishable from magic”

Arthur C. Clarke

Dear Rational Optimist,

A time traveler from the past would certainly agree that much we take for granted today qualifies as magic.

Increasingly, the genies in the machines are powered by batteries—ranging from the tiny ones in your Apple Watch to grid-scale units which hoard energy from the sun and can power a small city in an emergency.

Batteries have become so ubiquitous we now take them for granted. In this monthly Deep Dive – which you’ve received in lieu of my colleague Stephen McBride’s usual Rational Optimist Diary – we aim to give them the recognition they deserve.

The basic function of any battery is to receive an electrical charge, store that charge, then release it on demand. Rinse and repeat. Simple as toast.

The simplicity ends there. Battery science involves overlapping areas of expertise, each of which require a PhD to master, including metallurgy, electrochemistry, solid-state chemistry, materials science, physics, nanotechnology, thermal engineering…

Thus, out of concern for your sanity and mine, I decided to forgo delving too far into the weeds of electrochemistry science and instead focus on seven key factors contributing to the growing importance of batteries in our modern world.

The applications of batteries are so numerous and diverse, it is hard to generalize.

But if there’s an arc to this story, it’s that we humans have gotten pretty good at small batteries. Safe, long-lived, mass produced batteries for laptops and cell phones? No problem.

But as scale increases, so do problems. Car batteries are pretty close to solved. Batteries that can power a home? On the way. Grid scale batteries? A tougher nut to crack, but a problem brilliant minds are tackling.

Here’s a thought: Enough solar energy reaches earth to power humanity 8,000 times over. If we could capture and store this energy in batteries, we’d be good to go, with many of humanity’s biggest problems solved.

This sort of challenge is a long way from the sorted column, but as you’ll read, we are moving in that direction.

Just above I mentioned the ubiquity of batteries. That means each incremental improvement in battery tech can literally spawn whole new industries. Case in point: the No. 1 reason the drone industry is now flourishing is that batteries have gotten cheap, light, and efficient enough to reliably power them. What new industry will be next?

As it is unavoidable, we’ll start with a quick explainer on the basic technology and then move on to the interesting stuff, including breakthrough work being done with the potential to change the world.

At the end of this already too-long document I include a more comprehensive appendix under the appropriately titled subhead “The Weeds” which you may find useful in understanding all things battery.

Yet, because the terms invariably come up in the body of this treatise, here are a few useful reference points:

(Note: For comparison purposes, I use Tesla a fair bit, but only because the data for the world’s largest EV car maker is more readily available).

Volt (V) measures electrical pressure, or how strongly electricity is pushed through a circuit. Think of it as the "force" that moves electrons. A typical home outlet in the US provides 120 volts. A Tesla’s battery pack runs at around 350 to 400 volts.

Ampere (Amp or A) measures the flow of electricity—how many electrons are moving. You can think of it like the width of a pipe: the more amps, the more electricity flows. A hairdryer might draw 10 to 15 amps; fast EV chargers can deliver hundreds.

Kilowatt (kW) measures power. The rate of energy use, or production. For instance, a typical microwave uses about 1,000 watts, or 1 kW.

Kilowatt-hour (kWh) measures energy used over time. If your 1 kW microwave runs for one hour, it uses one kilowatt-hour of energy (kWh). When cruising along a level highway, a Tesla Model 3 consumes just over one-third of a kilowatt-hour for every mile driven.

Megawatt (MW) is equal to 1 million watts or 1,000 kW. For context, a megawatt can power about 800 homes.

Gigawatt (GW) is equal to 1 billion watts, 1 million kW, or 1,000 MW. A gigawatt is enough to power approximately 800,000 homes simultaneously. Peak demand in a city the size of New York might exceed 10 GW.

And with those terms close at hand, we begin, with the caveat that passing science in grade school was due almost entirely to my skill at finding a seat just behind one R. Hamada during examinations.

In the Beginning

Batteries as we know them were invented in 1800 by Signor Alessandro Volta, an Italian scientist.

He was building on the earlier work of Luigi Galvani, who, during his experiments with frog legs, observed the legs twitched when touched with metal instruments. Galvani believed the phenomenon was caused by “animal electricity”—a life force inherent in living tissue.

Inspired, though unconvinced by Galvani’s work, Volta began his experiments, correctly positing it was the metals used in the experiments—copper and zinc—and their contact with the moist tissue of the frog legs which was responsible for the twitching.

Through trial and error, Volta came up with the appropriately named Voltaic Pile: a pile of alternating copper and zinc discs separated by brine-soaked cloth. This simple device, pictured here, was the first battery.

While harnessing electricity was useful for other scientists of the epoch wanting to study the phenomenon, this shocking discovery wasn’t commercialized until around 1840, when clever folks figured out how to use it to electroplate inexpensive metals like brass with thin layers of silver or gold.

This allowed manufacturers to offer decorative items—such as the jug shown here—at more affordable prices than if they were cast from, say, solid silver.

The first batteries sold to consumers appeared in 1896, in the form of the Columbia “dry cell” battery from the National Carbon Company, the predecessor to EVEREADY. If you glance upward, you’ll recognize these batteries as little more than Voltaic piles wrapped in commercial wrappers.

A major difference in dry cell batteries is that, instead of using unwieldy liquid electrolytes (salt water in Volta’s case), the Columbia batteries used an ammonium chloride paste.

That’s the corrosive goop which, to this day, oozes out when you leave the batteries in your flashlight too long.

It wasn’t until the 1970s that the first lithium-metal batteries came to market. Typically used for cameras and small electronics, they were smaller and, importantly, were non-rechargeable.

That changed in 1991 when, based on the Nobel Prize winning work of John Goodenough and Akira Yoshino, the Sony Corporation first launched the rechargeable lithium-ion (Li-ion) battery.

Key Factor No. 1: Lithium is the GOAT of battery metals

In addition to being used to treat bipolar disorder, and inspiring Kurt Cobain of Nirvana to write a song by the same name, various iterations of lithium carbonate turn out to be almost perfect for storing and discharging energy:

It's super light: Lithium is not only the lightest metal on the periodic table, it is the third lightest element. Only hydrogen and helium gases are lighter. This lightness enables the production of lightweight batteries able to store a lot of energy—perfect for phones, laptops, and electric cars.

High voltage: Lithium can produce a high voltage, which means it can deliver a lot of energy on demand.

It reacts easily: Lithium quickly gives up its electrons, which makes it really good at moving energy in and out of the battery during charging and use.

Tiny ions: Lithium ions are very small, so they can move quickly in their race through the battery. That means faster charging and better performance.

Low cost: As we’ll discuss momentarily, the price of lithium-ion batteries has fallen precipitously over the last decade.

Lithium’s lightness is not an insurmountable challenge for competing metals, but it is a very high hurdle.

Of course, when any innovation hits the market, it typically costs a lot, which was very much the case with the early lithium-ion batteries.

Wright’s Law to the Rescue

Thanks to Wright’s Law—which predicts that every doubling of production leads to about a 20% drop in cost, the price of lithium-ion batteries plummeted from around $790 per kilowatt-hour in 2013 to $115 in 2024, a game-changing decline of 85%.

As you can see in the two charts below, this deep reduction in the price of lithium batteries enabled the Electric Vehicle (EV) revolution and paved the way for viable 'green power' solutions.

Simply, none of these technologies would have been possible without the ability to store large amounts of energy efficiently and economically.

As optimists, we like to think there’s a breakthrough just over every horizon, yet after chasing down too many rabbit holes to count, I have concluded that, for the next 5 to 10 years, lithium-based batteries will remain the gold standard.

That is almost certainly the case for batteries which are manufactured at scale for consumer electronics, EVs, power storage and so forth.

My apologies if that assessment disappoints. After all, it seems that pretty much everywhere you look these days you’ll find loud claims that lithium is about to be unseated by this or that new technology.

Here and there on YouTube you will find click bait for videos which hold nothing in reserve in touting that, thanks to the imminent debut of aluminum-ion batteries (to name just one example), the end of lithium is just around the corner.

Dutifully, I threw myself into the science and found that aluminum-ion batteries face huge challenges. The odds of them replacing lithium in the aforementioned timeline is close to zero. The same is true of sodium-ion batteries, or sulfur-ion, or solid-state ceramic batteries… or…

Why the Race for Lithium Replacements?

If my assessment that lithium-based batteries will remain the gold standard is correct, why are so many research teams expending hundreds of millions of dollars trying to unseat the technology? For the answer, let your eyes drift over this table.

Observe that the price of battery metals, in particular lithium, went to the proverbial moon in 2021/2022.

As you would expect, skyrocketing prices provided a powerful incentive for research teams worldwide to search for less expensive battery metals, studying any element or compound capable of forming ions to see if it could be harnessed for the job.

Confronted with that sort of price spike, experienced commodity traders enjoy quipping, “The cure for low prices is low prices, and the cure for high prices is high prices”.

And so it was that, concurrently with research ramping up in the quest for cheaper battery metals, producers of these metals in places such as Chile, Australia, Indonesia, and Africa cranked up production. As sure as night follows day, prices collapsed.

With the financial incentive to replace lithium removed, dozens of new battery tech start-ups closed shop, leaving a scattering of zombie companies still trying to raise funds to keep their research ambitions alive.

No easy task, given that for most applications any new battery tech must (a) produce batteries that are no heavier than those built with the third-lightest element on the periodic table, (b) be at least as energy dense as lithium, and (c) cost no more.

It may happen, but not any time soon.

At the risk of being repetitive, here’s my conclusion on battery tech:

For the wide range of requirements batteries are now used for—from the smallest devices to grid storage and everything in between—lithium-based batteries (Li-ion and LFP) remain the gold standard and are likely to remain that way for the foreseeable future.

My conclusion was echoed recently by the Chief Technology Officer of Panasonic, the world’s fourth largest battery manufacturer who, in an interview with the Financial Times, said he believes increasing improvements in lithium-ion batteries will make it very hard for solid-state batteries to gain market share.

That simple truth is reflected in the outlook for lithium-ion batteries.

Here’s a quick look at the dominant battery manufacturers around the globe. It may not surprise you to learn China pretty much owns the market.

Key Factor No. 2: China is the battery behemoth

Globally, no one else is close

In our very enlightening conversation with Ethan Loosbrock, Founder/CEO of battery start-up Ouros, we asked him which of the existing battery manufacturers most impressed him. With barely a pause, he replied “CATL”.

And for good reason: CATL, founded in 2011, currently controls approximately 36% of the global EV battery market. Put another way, CATL manufactured more than 1 out of 3 EV batteries installed in cars around the world.

Paraphrasing Loosbrock, he respects CATL not only for their size, but for the company’s ability to build new factories on a timeline no other battery company in the world can match.

CATL’s client list includes pretty much every important EV car maker in the world, including Tesla, BMW, Ford, Mercedes Benz, Volkswagen and others.

In addition to its lithium-ion batteries, the company also leads in LFP (lithium-iron phosphate) batteries, which are increasingly dominating the Chinese EV market, and being used in larger scale energy storage solutions. More on LFP batteries in due course.

Here’s a bit more on CATL and other major battery manufacturers.

CATL (Publicly traded on the Shenzhen and Hong Kong Stock Exchanges)

World leader

With a market cap of around US$180 billion, CATL is one of China’s most valuable companies. No real surprise, given that the Chinese government has prioritized its success as a “national champion”.

CATL followed a time-honored playbook to capture 37% of the global market: efficiently manufacture high-quality batteries at scale and sell them at prices Western competitors cannot match.

In 2024 the company produced about 300 GWh of batteries from a total of 13 large battery plants, with 11 in China and two in Europe.

To add to that capacity, CATL is on schedule to open a new gigafactory in Spain with a planned production capacity of 50 GW, and Ford is currently constructing a plant in Michigan using technology licensed from CATL.

BYD (Publicly traded on the Shenzhen and Hong Kong Stock Exchanges)

Integrated EV battery and car manufacturer

BYD, an acronym for Build Your Own Dreams, started in 1995 as a battery maker, but has evolved into a vertically integrated battery power company producing both electrical vehicles and batteries.

Here in England, and even more so in Europe, BYD electric cars are viewed favorably for their design, quality and price. A luxury BYD EV in Germany costs about €20,000 less than a comparable Tesla.

In 2024 BYD produced about 157 GWh of battery cells—roughly 18% of global supply and about half of CATL’s output.

LG Energy Solution (Publicly traded on Korean Stock Exchange)

Globally diversified

Originally a division of South Korea’s LG Chem conglomerate, LG Energy Solution, headquartered in Seoul, was spun off as a separate company in 2020.

It currently controls roughly 10% of the global EV battery market, producing batteries from factories strategically positioned near key markets.

Specifically, the company operates plants in Korea and China, plus three in the United States. Its largest facility, located in Poland, produces 86 GWh per year and supplies batteries to every major European EV manufacturer.

Panasonic Energy of North America

Largest US EV battery manufacturer

A subsidiary of Panasonic Energy of Japan (the world’s fourth-largest battery manufacturer), PENA is the largest producer of EV batteries in the United States, with a factory in Sparks, Nevada, and another that opened this year in De Soto, Kansas.

In Sparks, the company’s factory, co-developed with Tesla, currently produces approximately 41 GWh/year, primarily in the form of lithium-ion batteries for Tesla’s Nevada Giga-Factory.

When the Kansas factory is fully operational, it will add about 32 GWh to PENA’s North American production.

While this Deep Dive focuses primarily on EV and large-scale power storage solutions, it’s worth noting that in the realm of non-EV batteries—such as those used in phones and other consumer electronics—the big three are:

Amperex Technology Limited (ATL) – Based in Hong Kong but wholly owned by Japan’s TDK, ATL controls roughly 50% to 60% of the global smartphone battery market, making it the clear leader in the consumer electronics market.

Its core products are ultra-thin pouch and flexibly shaped Li-ion-polymer cells for phones, tablets, wearables, drones and AR/VR devices. Their client base includes Apple, Samsung Electronics, Oppo/Vivo, DJI and most Tier-1 laptop manufacturers.

As an aside, the CATL EV battery giant was spun out of ATL in 2011.

Samsung SDI – the South Korean conglomerate ranks No. 2, with about 15% of the market for small device batteries for smartphones, laptops, tablets and power tools.

Panasonic Energy (Panasonic Holdings) – Headquartered in Osaka, Japan, Panasonic has been a lithium-battery pioneer since the early 1990s. Its core products are high-energy cylindrical and prismatic Li-ion cells for premium laptops, cameras and more.

Key Factor No. 3: The evolving state of charging

One of the biggest headwinds for the EV market has to do with “range anxiety”— the fear of running out of charge while driving. Charging time is a close second.

The modern human is not particularly patient. Thus, a fueling stop of no more than 15 minutes—which includes time to pick up a greasy breakfast sandwich—is about the limit of how long we’ll happily wait.

Even though upwards of 80% of EV owners charge at home, public charging stations need to be ubiquitous for the EV market to continue gaining momentum.

Here are some interesting items I discovered on that topic.

Tesla Oasis Supercharger

Biggest charger in the United States

The first phase of the Tesla Oasis Supercharger in Lost Hills, California opened in July 2025, with 84 of the planned 168 V4 Supercharger stalls now operational.

The Tesla V4 charger can deliver up to 325 kW of power, but there are some important variables to consider.

For example, other than Cybertrucks, most Tesla cars come with 400V systems and, for safety reasons, are capped at around 250 kW charging power. Furthermore, as they charge past about 50% that tapers down to about 100 kW.

The Cybertruck, with an 800-volt system, can theoretically take the full 325 kW charge, but peaks at about 300.

Not to get too deep into the weeds… if all 168 stalls at Oasis were being used simultaneously, charging would require about 25 MW of power, enough to power about 21,000 US homes.

That’s a lot of power.

Yet, as of this writing, the Oasis Supercharger receives just 1.5 MW from the local electrical grid.

The rest of the power comes from 10Tesla Megapacks, capable of storing 39MWh of energy, and delivering about 19 MW of power simultaneously. Importantly, those Megapacks are integrated with a 11 MW solar grid covering 30 acres of land.

As it is unlikely all 168 stalls will be occupied at the same time, this very clever bit of engineering means that not only is Oasis able to provide all the charging power which might be required, but it can do it entirely, or almost entirely, off the grid.

To help drivers cope with charging times, which currently average around 25 minutes, Tesla is building an upscale driver’s lounge and cafe at Oasis, similar to that installed at the Tesla Diner.

Tesla Diner

Turning lemons into lemonade

The new Tesla Diner has been on the news a lot lately, primarily for its futuristic vibe, which includes Optimus Robots serving popcorn.

The Diner has 80 V4 Supercharger stalls. Using the same calculations as Oasis, if all 80 stalls were occupied, it would require about 12 MW of power. As the Diner has a considerably smaller footprint, just 2 acres, where does the power come from?

As far as I can tell, other than a relatively minor power contribution from the solar panels on the canopies of the charging stations at the Diner, most of the power comes from the local Los Angeles power grid.

At the Diner, drivers can eat, drink and watch movies on two large movie screens.

In time, when FSD cars become widespread, you’ll likely be able to have a glass or two of wine while waiting for your car to charge.

Regardless, it’s an interesting concept, turning the lemon of waiting time into the lemonade of adding to the bottom line by selling food and drink.

Minle EV Charging Station, China

World’s largest

To give you some idea of the scale at which charging stations can be built, the Minle Charging Station in Shenzhen, China has a whopping 637 charging stalls.

Unlike the Tesla Superchargers, which are open to the public, the Minle Charging Station is dedicated to servicing the over 22,000 BYD taxis which operate in Shenzhen.

A second large charging operation in Shenzhen, at the at Shenzhen Bao'an International Airport and operated in a partnership with BYD, has 258 fast-charging stalls.

The world is going to need more power.

Battery Swapping

One way of tackling demand on the grid, and the time required to charge, is to enable drivers to quickly swap out their depleted battery for a charged one.

Tesla initially planned on setting up a swapping network before abandoning the idea due to the high implementation costs.

Which is why I found it interesting that battery swapping is already a thing in China and is beginning to pop up in India and even Europe.

The advantages of battery swapping are obvious. For example, the swapping stations can charge their battery inventory outside of peak hours. But most importantly, the entire automated swapping process takes no more than 3 minutes.

So, no sitting around in cafes watching movies while waiting for your car to charge.

NIO (Listed on multiple exchanges, included as an ADR on NYSE: NIO)

Chinese battery swapping pioneer and clear leader

As of this writing, the Chinese electric car company Nio, which debuted its first swapping station in 2018, operates over 3,300 swapping stations in China. Impressively, the company’s stations have already completed more than 84 million swaps.

The company is working toward a goal to reach 4,000 stations within the next year, with half of those stations located outside of China.

The photo here shows the compact nature of Nio’s fully automated swapping station. Their latest model, the Power Swap Station 4.0, can accommodate 23 batteries, allowing up to 480 swaps per day. You pull into the bay and robotic arms remove your battery pack and, presto, swap in your new pack and off you go in under 3 minutes.

The company, with the active support of the Chinese government, is collaborating with other major EV manufacturers to adopt standardized battery packs so they will also be able to use the NIO quick swapping stations.

The cost of a swap runs from US$10 to $25, which is cheaper than the cost of ‘charging up’ in much of the West.

Nio also offers Batteries-as-a-Service (BaaS), allowing you to reduce the cost of your EV by leasing your battery pack separately from the car.

According to EV Digest, a Nio Onvo EV costs about $39,000 when purchasing it with a battery pack, and below $25,000 without it. You would then pay about US$150 a month to lease the battery pack.

For some models, the leasing price even includes unlimited swapping, greatly reducing the operating cost of the car.

Of course, while the swapping stations look simple, they’re expensive to implement as they need to be integrated into the grid and able to access sufficient power to fast-charge multiple battery packs at once.

While swapping may not yet be viable for personal vehicles, for taxis and ride-hailing services which need regular charging, it’s a no brainer.

Looking at the financial metrics for Nio, it’s clear the company is fortunate to have support from the Chinese government, as it is highly leveraged and not currently profitable.

Whether Nio will reach profitability, or battery swapping will become a major component in the battery economy is hard to tell at this point. But I hope they succeed, because they are clearly focused on reducing the friction of EV ownership—a good thing.

Key Factor No. 4: Home charging systems

While much of this Deep Dive focuses on EV batteries, I found the latest home battery storage systems most interesting. Here’s a quick overview.

Tesla Powerwall

The Tesla Powerwall, which costs around $10,000 installed, stores 13.5 kWh, and can deliver up to 5kW. Rather than Li-ion batteries, the Powerwall uses Lithium Iron Phosphate (LFP) batteries, which are significantly safer and have a much longer life.

If you wish, you can chain up to 3 units together, increasing your power storage to over 40 kWh.

The Powerwall is designed to be attached to the grid and/or to a solar array.

In an “essential loads” scenario—i.e., a widespread outage—the critical electrical needs of a house (refrigerator, some lights, internet, water pump, etc.) run about 9 kWh a day.

Which means Powerwall can easily power your house during the night, then recharge during the day with the excess power generated by solar. In sunnier climes, the Powerwall system might allow you to live off the grid indefinitely.

From the latest (Q2 25) earnings call, we learned that Tesla’s energy business achieved record revenue and profits, helping to offset automotive declines.

Base Power (Private)

Headquartered in Austin, Texas, Base Power was founded in 2023 by Zach Dell (son of Michael Dell) and former SpaceX engineer Justin Lopas.

Base Power caught my eye because of its unique business model. If you're located within their Texas-centered service footprint, they will install a fully functional residential backup battery system, providing between 25 and 50 kWh of storage capacity, for as little as $600. You then pay a monthly membership fee of between $19 and $29.

Considering the five-figure price tag associated with a Tesla Powerwall or similar solutions, the Base Power system represents quite a deal. How can they offer backup power at such a reasonable cost?

As part of the deal, Base Power becomes your primary electricity provider, meaning you pay them a per-kWh rate in addition to local utility delivery charges. This results in a small premium – about $4 per month – compared to what you might pay with another retail electricity provider.

Including the monthly membership, your total extra cost might come to around $30 per month, which still feels reasonable given the included Base Power backup solution.

While a minor portion of Base Power's current revenue stream, the company also earns money through energy arbitrage, charging the batteries in their customer network when grid electricity is inexpensive, then selling it back to the grid when prices are high. As their customer base grows from thousands to potentially tens of thousands of units, revenue from arbitrage could become significant.

Unlike Tesla's Powerwall, which integrates seamlessly with solar panels as well as the grid, Base Power’s units only connect to the grid, though solar integration is in development.

Signaling possible aspirations for a national rollout, Base Power recently raised $200 million from prominent tech-focused investors, including Addition, Andreessen Horowitz, Lightspeed Venture Partners, and Valor Equity Partners.

Coming soon to your neighborhood? Maybe?

Impulse (Private)

Impulse is reimagining household power storage with a cooktop that runs off an integrated 3kWh battery. The battery can deliver up to 10,000 watts of peak power per burner—enough to boil water in under 40 seconds.

Should the power go out, the battery has enough juice to let you continue using the stove for at least a few meals.

The cooktop is the company’s first product, but their vision is a future where all major appliances have batteries integrated into them, perhaps to the point where, should the power go out, the batteries could collectively power the house for a reasonable period.

Key Factor No. 5: Grid-scale batteries

While the use of grid-scale batteries is still limited, the trend for greater adoption is in motion.

These battery storage farms offer several key advantages. For starters, they can be brought online almost instantly to provide stabilizing power to the grid in the event of an unforeseen issue—such as the failure of a transformer.

They can also readily receive and store power during periods when power from variable sources, such as solar, are at their peak.

On Kaua‘i, Hawaii, a 28 MW solar farm with 100 MWh of Tesla Megapacks can provide power to a large percentage of the island’s ~70,000 residents for several hours during a blackout.

A new $106 million Tesla Megapack battery system just started operating near San Diego. Built by Arevon Energy, it uses safer LFP batteries to store enough electricity to power about 200,000 homes for two hours a day during periods of high demand.

The facility uses the Tesla 2XL Megapack, a large-scale battery energy storage unit designed for utility and commercial use. To give you a general idea of these grid-storage batteries, here are some specifics.

Weight: 84,000 pounds (38,100 kg).

Size: 28.87 feet long, 9.14 feet wide, and 5.41 feet high (8.8 meters x 2.785 meters x 1.65 meters).

Energy storage: Up to 3.916 megawatt-hours (MWh) per unit, with a power output of 1.927 megawatts (MW).

Cost: Approximately $1.39 million per unit, though actual pricing varies based on volume, location, and market conditions (recent estimates suggest it could be as low as $1.04 million in some cases).

The decision by Tesla to use LFP batteries in its Megapacks (and Powerwall systems) is smart, because of the longer life of LFP batteries, and, more importantly, the safety of the technology.

The wisdom of that decision is clear when we consider the disaster at Vistra Corporation’s Moss Landing facility in California. Once the world’s largest grid-scale battery installation, capable of delivering 400 MW of power, its status changed in January of this year when a fire—triggered by thermal runaway in a single battery rack—spread and destroyed or damaged roughly half of the batteries. Most of the units involved were LG Energy Solution TR1300 NMC (Li-ion) battery racks.

As of this writing, the entire complex remains shut down due to damage and heightened safety concerns, except for one module of Tesla LFP batteries, which were undamaged and remain operational. We’ll have more on battery fires shortly.

In terms of revenue potential, Tesla earns about $400 million in revenue for every 1 GWh of energy storage deployed. In Q2 2025 the company reported 9.6 GWh of energy storage deployments with the expectation that it will deploy 10 to 12 GWh in Q3.

Analysts expect Megapack revenue to exceed US $12 billion in 2025. In time, Tesla expects its power division to rival that of the automotive division, which currently generates ~$70 billion in revenue annually.

The bottom line: with the right technology, such as LFP instead of Li-ion, grid-scale batteries are the real deal. They’re ideally suited for storing and seamlessly integrating solar power into the grid, as well as providing “instant-on” support during demand spikes or grid failures.

Key Factor No. 6: EV battery fires are infrequent, and their numbers will continue to fall

Earlier, I mentioned some of the key attributes for successful battery technology, including weight, energy density and cost.

But there’s one attribute which trumps them all: safety. No matter how good your battery is, if it’s prone to catching fire and blowing up, your order sheet will be rather empty.

While one could extol the virtues of Lithium-ion batteries until the proverbial cows wandered home, a flaw in the technology raises its ugly head on occasions in the form of thermal runaway.

In these instances, chemical reactions set off by damage to the battery from overheating, a puncture, or poor manufacturing, can lead to thermal runaway. If not caught in time, the result can be an intense fire and possibly an explosion.

How intense? As much as 2,000°F (1,100 °C). That’s on par with molten lava.

Adding to the problem, the burning batteries emit toxic fumes and, because it’s an electrical fire, fighting it with water is problematic. Firefighters are never thrilled when the call comes in to fight a battery fire.

Just last month, the Matson Shipping company announced it would no longer accept EVs or lithium battery shipments on its vessels.

They did so because, since 2020, at least five large container ships have been seriously damaged or destroyed by lithium battery fires.

One of them, the Felicity Ace, shown below, made a lot of news in February 2022 after burning for weeks before finally sinking to the bottom of the Atlantic, taking with it 4,000 cars (including 1,000 Porsches and 200 Bentleys).

More recently, in June 2025, the Morning Midas, carrying 3,000 cars, including electric and hybrid vehicles, burned and sank 1,200 miles off the coast of Anchorage, Alaska.

But here’s the interesting thing.

Despite all the arm-waving, battery fires in EVs are a lot less common than the media would have you think.

“Analysts from AutoInsuranceEZ examined data from the National Transportation Safety Board to track the number of car fires and compared it to sales data from the Bureau of Transportation Statistics. The result? Hybrid-powered cars were involved in about 3,475 fires per every 100,000 sold. Gasoline-powered cars, about 1,530. Electric vehicles (EVs) saw just 25 fires per 100,000 sold.”—Kelley Blue Book

In addition to improved manufacturing processes, advanced battery-monitoring systems, and new heat-resistant materials, another important step toward reducing thermal runaway has been the shift away from NMC (Nickel, Manganese, Cobalt) lithium-ion batteries—the dominant battery chemistry for EVs—toward Lithium-Iron-Phosphate (LFP) batteries in certain applications.

As illustrated here, while LFP batteries don't match the higher energy density (and thus, driving range) of NMC batteries, they are significantly less prone to thermal runaway.

Because of the safety aspect and longer cycling life—LFPs last about twice as long as Li-ion—there’s a lot of research going into improving LFPs.

Even so, LFPs are already good enough for Tesla to use in its Powerwall home battery systems, and for the batteries in its base model EVs.

And the global adoption of LFP EV batteries has been gaining momentum, increasing from only 30% in 2022, to where today LFP batteries are used in over 50% of all EVs.

One source I reviewed reports that upwards of 90% of the EVs made in China now use LFP batteries. They are well suited to the Chinese market as most of the EVs there are in urban areas, where safety and durability are prioritized over range.

Electric Scooters & E-Bikes

Still on the topic of safety, most of the battery fires you hear about do not involve electric cars, but electric scooters and e-bikes.

In virtually all those cases, the culprits are cheap and poorly made or damaged second-use batteries, mainly from China.

Recognizing this reality, in recent years governments around the world, including China, have begun requiring rigorous new battery safety standards.

New York City, which has a high density of e-bikes and scooters, recently made Underwriters Solutions (UL) certification mandatory with heavy penalties for retailers which offer non-certified batteries. That’s because the rate of scooter and e-bike battery fires from (UL) certified manufacturers is pretty much zero.

For those of you who own an electric scooter or bike, you might want to wander out to the garage and check to see that the battery has the distinctive UL Mark.

Thus, while thermal runaway is not yet in the “problem solved” column, it’s close.

Meanwhile, there are a lot of smart people pursuing different approaches to relegating battery fires to the annals of history—from better manufacturing processes to heat-resistant separators and cell wrappers, as well as built-in battery monitoring with auto-shutdown mechanisms.

A sampling of companies working on thermal runaway

Honeywell (NYSE: HON)

Sensors to stop thermal-runaway before it runs away

Honeywell’s Battery Electrolyte Sensor (BES) detects electrolyte vapors released during early stages of battery degradation (e.g., overcharging or physical damage). It then triggers safety protocols like disconnecting charging to halt progression.

Aspen Aerogels (NYSE: ASPN)

Better separators

Aspen’s PyroThin Cell-to-Cell Barriers use aerogel-based thermal barriers between cells to resist heat transfer and manage runaway events. Videos of the company’s Aerogels in action are impressive. In one, despite superheating one side of the Aerogel sheet to over 1000 °C, the temperature on the other side of the sheet remained under 100 °C.

Electrolock Insulation Solutions (Private)

A variety of heat-resistant solutions for manufacturers

The company, which has been around since 1957, offers a wide variety of engineered insulators designed to help manufacturers prevent runaway through thermal management. You have to be a geek to understand the various nuances of their extensive product line, but I am assured they work.

KULR Technology Group Inc. (NYSE: KULR)

Battery-tech and… bitcoin?

Kulr has a portfolio of over 7 patents related to cell “wrappers” that effectively prevent thermal runaway. Its client base includes NASA which uses Kulr’s tech to protect mission-critical batteries in spacecraft.

Somewhat oddly, last year, the company pivoted to also becoming a “bitcoin company”. In addition to keeping the majority of its corporate reserves in bitcoin, it has also launched a bitcoin mining operation in Paraguay.

Regardless, the company continues to sign a lot of contracts for its battery tech and, as long as bitcoin keeps going up, good on them.

Viking HydroPen (Private)

Container Ship Fire Fighting System

Given the Matson decision, having a practical (i.e., effective and economical) system to fight a battery fire on a giant container ship seems a no brainer, and Viking, a Danish company, seems to have come up with just that. Simplicity itself, the system uses a water powered drill attached to an extending handle.

When thermal imaging or a built-in battery monitor identifies a container as heating up, a single crewman connects the rig to the ship’s existing fire hose system and attaches the unit to the side of the affected container. The water pressure then powers the drill to cut into the container, and then fill it with water, safely extinguishing the fire.

It's a clever and useful system.

Key Factor No. 7: Battery recycling

In the early days of EVs, which arrived hand-in-glove with the environmental movement, I was quick to conclude that, in time, a new environmental crisis would be created by mountains of expired battery packs chock full of toxic materisals.

It turns out my pessimism was largely unfounded.

Let’s start with the good news.

The technology required to fully recycle all manner of batteries exists, including the lithium-ion batteries found in most of the 58 million EVs now tooling around on global highways.

Toxic waste?

No problem, as the modern recycling process is greenish and can extract up most of the valuable battery metals (nickel, cobalt, manganese and lithium carbonate) which can then be resold to the battery manufacturers.

The remaining waste is reduced to a non-toxic black mass which can then be disposed of in conventional landfills or even used for things like road building.

The bad news?

Let’s start with simple economics. Bringing back into the scene the table I trotted out earlier, we are reminded that, in 2022, lithium-carbonate—just to give one example—peaked at a whopping $84,500 per tonne.

The other battery metals went through the same sort of pricing euphoria. Which meant, for a battery recycler dependent on the end price of the metals you extract for the bulk of your revenue, these were happy days.

However, the subsequent collapse in prices was anything but happy for the battery recyclers, whose plants are very costly to build. In the case of recycled lithium-carbonate, virtually overnight they were earning 83% less.

The list of recycling companies which went bankrupt is long. And the carnage is far from over. Recently, the largest bankruptcy in the history of modern Sweden occurred, when Northvolt, an aspiring “green” battery manufacturer with a focus on recycling went under with debts of well over $4 billion.

Unfortunately, because the world needs reliable recyclers, there are other powerful challenges faced by the survivors.

Including the race for a new paradigm in batteries which, despite no imminent success, will eventually be won.

Imagine being the CEO of a battery recycling firm whose business relies upon deploying a billion dollars to build a modern recycling plant. And that plant relies primarily on selling recycled nickel, cobalt, manganese and lithium for its revenues.

But suddenly, along comes along a company such as Ouros (more on them later) who finally breaks the proverbial code to produce a better battery that does not use nickel, cobalt or manganese in the manufacturing.

In that scenario, the prices of those metals fall—hard —at the same time your primary customers no longer need what you’re selling. It’s a harsh reality.

While one recycling executive told me they would adapt as necessary to disruptive new technologies as they appear, it’s a hard thing to plan for.

In the way of a bright spot for recyclers, according to the International Energy Agency (IEA), global recycling capacity will increase to the equivalent of 1.3 million battery packs by 2030, more than twice forecasted for the supply of expended battery packs each year.

Simply, by 2030 the supply of batteries ready to be recycled each year will exceed the ability of recyclers to recycle them by more than two to one. At that point, the existing companies will have an incentive to expand, and new companies to enter the business.

Especially if governments mandate that a recycling charge is built into every battery pack sold to offset the cost of recycling a battery, which currently runs about $700. We are seeing legislative moves in that direction.

Of course, that charge will be passed on to the customer, but it does represent a potentially life-saving revenue stream for recycling companies.

While there are dozens of companies in the recycling business (in various stages of financial health) in the interest of space and time I’m going to look at just two.

Redwood Materials (Private)

Pioneer in recycling and repurposing

Founded in 2017 by Tesla co-founder JB Straubel, Redwood Materials operates the industry’s leading used battery logistics network. That network allows the company to receive and recycle or repurpose about 70% of all used EV battery packs in the US.

After receiving a battery, Redwood analyzes it for remaining energy capacity. If that capacity is above 50% and the battery is structurally sound, the battery will be saved for deployment in portable energy storage systems.

If the energy capacity is below 50%, or the batteries are damaged, they are recycled, with the company recovering over 95% of metals from batteries and producing cathode and anode materials for partners like Panasonic, Ford and Amazon.

Between reusing and recycling, Redwood’s operations in Nevada and South Carolina process the equivalent of about 250,000 EV battery packs annually.

As proof of concept for its relatively new battery reuse initiative, the company installed a 12 MW solar connected microgrid, made up of 805 retired EV battery packs, in Sparks, Nevada. That microgrid provides substantially all of the power required by the adjacent Crusoe data center.

Today the company processes more than 20 GWh of batteries each year, but they are gearing up to process a lot more.

Ascend Elements (Private)

Environmentally friendly innovator

Fast Company’s No. 1 company in the Automotive category of its 2024 rankings of the World's Most Innovative Companies, Ascend Elements operates one US-based recycling plant, soon to be joined by a second, and is currently working to open a third, in Poland.

At its Covington, Georgia facility, which has been in operation since 2022, Ascend uses its patented Hydro-to-Cathode process to cleanly recycle up to 30,000 metric tons of batteries annually. That works out to about 70,000 EV battery packs.

A new plant in Hopkinsville, Kentucky, whose completion has been delayed until 2026 due to a business dispute, is aiming to produce enough new battery-grade materials, strictly from recycling, to make upwards of 750,000 new EV packs annually.

Impressively, the environmentally friendly Ascend recycling process can extract 98% of the metals from used battery packs for resale to battery manufacturers.

The residual 2% is non-toxic and can be placed into a normal landfill or even be used as a component in constructing roads or buildings.

So far, the company seems to be weathering the dip in metals prices. In my correspondence with Thomas Frey, Sr. Director of Ascend Elements, he informed me…

At current prices, we can compete with the landed cost of NMC pCAM* from Asia. We can also compete with the landed cost of lithium carbonate from South America.

And

The volatility of metals pricing certainly complicates the recycling business, but we are exploring strategies to mitigate risk. At the end of the day, large format lithium-ion batteries need to be recycled when they reach end of life. As long as there is demand for new lithium-ion batteries, recycling will be one of the best sources of critical battery materials.

Surprisingly, though the company does rely on some government grants to help with construction costs, it doesn’t receive subsidies.

Surprising because there has been a lot of talk about supply chain risks caused by geopolitical tensions. Again, according to Thomas Frey…

This summer, Ascend Elements began commercial-scale production of >99% pure, sustainable lithium carbonate (Li2CO3) recovered from used lithium-ion batteries at our battery recycling facility in Covington, Ga. This is a historic milestone for the domestic battery materials industry. This advancement marks the first time recycled Li2CO3 has been produced at commercial scale in North America. We plan to produce up to 3,000 metric tons of sustainable, domestic Li2CO3 per year, increasing total U.S. production of Li2CO3 by approximately 60 percent annually.

Given the growing importance of batteries to global innovation, financially healthy recyclers are of the utmost importance. Though, if million-mile batteries become a thing, that importance will be diminished.

* NMC pCAM (Precursor Cathode Active Material) is a powder-like substance used in lithium-ion battery production, made by chemically combining nickel, manganese, and cobalt.

The Million Mile Battery

Throughout this missive, the Tesla name pops up frequently. This is not only because they are the largest pure EV maker, but because they have a reputation as being a leader in battery-tech.

That reputation is in no small part thanks to a long-standing relationship with Dr. Jeffy Dahn, possibly the leading battery scientist in the world.

For over four decades, Dahn has done pioneering research in Lithium-ion batteries, authoring hundreds of peer-reviewed papers and securing over 60 patents. It is Dahn who is credited with developing the NMC-based cathode materials now widely used in EVs.

In 2016 he began an exclusive research partnership with Tesla which continues to this day.

Famously, it was Dahn who first theorized that EV batteries could have a functional life cycle of 1 million miles, an estimate he recently updated to be as much as 4 million miles.

While I am not sure about the latter projection, as Tesla EV batteries already retain 80% of their charging capacity after 200,000 miles, million-mile batteries seem doable.

In the vision shared by Dahn and, by extension, Tesla, you would purchase or lease a million-mile battery separately from your car. This battery could be used throughout your car’s lifespan and transferred to subsequent vehicles until it reaches the end of its functional life.

Should (when?) million-mile batteries make it to market, it will greatly reduce the number of expired battery packs needing recycling. A good thing.

Regardless, from a technical standpoint, we can move the problem of environmentally clean battery recycling into the “solved” column.

The Future

We live in an age of miracles, and batteries power an increasing number of those miracles.

In fact, without the successors to Signor Volta’s discovery, there would be no modern cars, planes, cell phones, portable computers, space travel, solar power, or virtually any portable electronics… the list goes on almost to infinity at this point.

Though lithium batteries (NMC Li-ion & LFP) are well protected behind tall walls, surrounded by a deep moat at the top of a very steep hill, battery innovation is far from having run its course.

For reasons already discussed, I remain skeptical about much of the non-lithium battery experimentation now going on. Yet, I am confident that some of the new battery technologies will ultimately find a niche use.

For example, if it is mission critical your drone stays in the air for six hours, then Group 14’s patented silicon-carbon composite, used for the anode in a lithium battery, should soon be able to fill the bill. The battery may not last as long, in terms of cycle life, as a NMC Li-ion or LFP, but if you’re the US military, do you really care?

In the Netherlands, Ore Energy is currently testing an iron-air battery which could, theoretically, provide grid-scale batteries—where size and weight are less of a worry—with safe, 100-hour storage capability.

Ouros, whose founder Ethan Loosbrock was kind enough to sit for a very useful interview, holds a key patent in lithium-air technology.

With directional input from that patent, Ouros is working to develop a next-generation cathode which, by eliminating nickel and cobalt, has the potential to produce lithium batteries with 10X the current energy density at 1/100th cost.

While the company is still deep in the proof-of-concept stage, given the goal—and the financial rewards tied to achieving it—rest assured that they, or another equally dedicated research operation, will leave no stone unturned in their quest for a world-changing breakthrough.

Though plenty of challenges remain to achieving the kind of breakthrough we optimists love to see, to paraphrase Stephen McBride’s take on Artificial Intelligence, 'Today’s batteries are the worst they’ll ever be.'

The (battery-powered) future is so bright, we’re going to need sunglasses!

—David Galland

David Galland is a co-founder of the Rational Optimist Society.

P.S. Speaking of topics, what did you think of this topic? What would you suggest as topics for future Deep Dives? Drop me a note at galland@rationaloptimistsociety.com.

P.P.S. Please pass along our research to your friends and family with a strong recommendation to join as a member. The more Rational Optimists, the more impact we can have in helping people -- especially the young -- understand what a wonderful world we live in. Here’s a link for the membership sign-up page to copy and send along with your recommendation to join. Click here to join the Rational Optimist Society.

The Weeds

The Basic Battery

The underlying technology remains much the same as in the old Voltaic battery: two different materials (called electrodes) create a flow of electricity through a chemical reaction. But in modern batteries, the materials are more advanced.

The cathode (positive side) is usually made of a metal oxide, and the anode (negative side) is often made of carbon, like graphite.

Between them is a liquid called the electrolyte, made by dissolving lithium salt in a mix of solvents. These solvents are usually organic liquids that don’t conduct electricity themselves, but they let lithium ions move freely between the anode and cathode during charging and discharging.

Separating the anode and cathode is a thin, porous barrier made of plastic or plastic-like materials called the separator, which allows ions to pass through but keeps the electrodes from touching. If the separator fails or overheats, the battery will heat up quickly and, in some cases, catch fire or even explode.

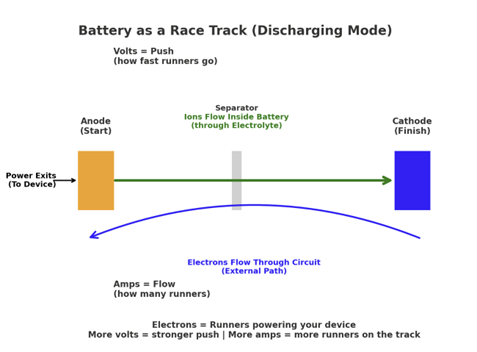

One way to think of the inside of a battery is to visualize it as a racetrack. The lithium ions are the racers, zooming back and forth between the anode (the starting line) and the cathode (the finish line) through a special track called the electrolyte.

But the track has a safety feature: a fence in the middle—that’s the separator. It keeps the racers from crashing into each other or crossing into the wrong lane. The fence has tiny holes that let the ions pass through, but it blocks electrons and keeps the anode and cathode from coming into contact.

If that fence breaks or melts (for example, if the battery overheats), the racers can pile up or veer off course—leading to a short circuit so, it’s really the separator that keeps everything safe and orderly.

Measures of Energy

With apologies to those of you for whom this is grade school knowledge, and for cutting corners by ignoring variables such as charging rates tapering off as a battery charges, I shall recap our glossary of terms.

Volt (V) measures electrical pressure, or how strongly electricity is pushed through a circuit. Think of it as the "force" that moves electrons. A typical home outlet in the US provides 120 volts. A Tesla’s battery pack runs at around 350 to 400 volts.

Ampere (Amp or A) measures the flow of electricity—how many electrons are moving. You can think of it like the width of a pipe: the more amps, the more electricity flows. A hairdryer might draw 10 to 15 amps; fast EV chargers can deliver hundreds.

Kilowatt (kW) measures power. The rate of energy use, or production. For instance, a typical microwave uses about 1,000 watts, or 1 kW.

Kilowatt-hour (kWh) measures energy used over time. If your 1 kW microwave runs for one hour, it uses one kilowatt-hour of energy (kWh). When cruising along a level highway, a Tesla Model 3 consumes just over one-third of a kilowatt-hour for every mile driven.

Thus, if the standard Model 3 battery pack has an energy storage capacity of about 60 kWh, dividing that by its average consumption of 0.35 kWh per mile yields a range of approximately 170 miles.

If the same car were driven continuously for 24 hours at highway speeds, it would consume around 360 kWh of energy.

By comparison, the average US home uses about 1.25 kWh per hour on average, or 30 kWh per day. That’s less than a 10th of the energy used by a Tesla.

In terms of economics, with the cost of powering the average US house currently running about $0.16/kWh, to power the average house strictly with electricity for a 24-hour period costs about $4.80 a day.

(Unless you live in a state such as California where, thanks to a long tradition of ill-considered policy decisions, the costs can run almost double the national average.)

Base Power

Moving on up… to larger scale energy measurements.

Megawatt (MW) is equal to 1 million watts or 1,000 kW. For context, a megawatt can power about 800 homes.

Gigawatt (GW) is equal to 1 billion watts, 1 million kW, or 1,000 MW. A gigawatt is enough to power approximately 800,000 homes simultaneously. Peak demand in a city the size of New York might exceed 10 GW.

Mechanism of Thermal Runaway in Lithium-Ion Batteries

Thermal runaway is a self-sustaining, uncontrolled increase in temperature within a lithium-ion battery, triggered by a cascade of chemical reactions.

The process starts with an internal or external event, such as overcharging, where excessive voltage breaks down the electrolyte or cathode, generating heat.

Physical damage—being punctured or crushed—can also short-circuit the battery.

High temperatures can also do the trick. (Has your mobile phone ever become overly hot from being left in the sun?) And, of course, manufacturing defects, where impurities in the electrolytes, or separator failures, can lead to short circuiting.

When a lithium-ion battery is subjected to a triggering event, such as overcharging or physical damage, it can cause a localized temperature increase, typically exceeding 80–120°C (176–248°F). This heat accelerates the decomposition of the flammable lithium-salt electrolyte, initiating a self-reinforcing cycle that generates additional heat and releases toxic gases, such as hydrogen fluoride and carbon monoxide.

At this point, with the temperatures rising above 392°F, the separator, the porous layer between the anode and cathode, melts or warps, allowing direct contact between the electrodes and then things start to get ugly.

As the cathode material (e.g., lithium cobalt oxide) begins to break down, it releases oxygen, fanning the fire as it is, fueling a rapid exothermic (heat-producing) reaction.

At this point temperatures can soar above 1,112°F, which is just shy of how hot fresh lava is, causing the battery to vent hot gases, ignite, or even explode due to pressure buildup from gas release.

The heat from one reaction triggers adjacent cells or areas, creating a runaway effect that spreads unless stopped, which, because it’s an electrical fire, is not easy to do. Of course, in a container ship with thousands of electric cars, once the many battery packs get involved then, well, it’s off to Davy Jones locker.

Miscellaneous Q&A which may be of interest

Q. I recently read that one of the battery giants was working on an EV battery that could be charged in 5 minutes with a 1,000-mile range.

Despite skepticism toward various emerging technologies, ongoing improvements in lithium-based batteries suggest that, by the mid-2030s, EV batteries—almost certainly lithium-based—will likely charge rapidly and provide a range of up to 1,000 miles per charge.

However, to keep this sort of thing in perspective consider that, absent a whole new paradigm in battery technology, to get 1,000 real-world miles of range would currently require a 400–450 kWh battery pack (most Tesla battery packs are 60 kWh)—which would weigh well over 2,000 pounds and cost ~$40,000+ at today’s prices.

While humanity will eventually develop a 400 kWh EV battery and the resurgence of nuclear power will help meet soaring energy demands, fast-charging such a high-density battery in the five-minute timeframe mentioned will require a completely new energy distribution system. And by “new”, I mean something which doesn’t even remotely exist today.

Let’s break it down.

Suppose your next-gen electric truck packs a whopping 450 kilowatt-hour (kWh) battery—about seven times the capacity of a base-model Tesla Model 3. Now imagine topping it up in just 5 minutes.

First, translate 5 minutes into hours: 5 ÷ 60 = 0.083 hours

Using the basic energy-power-time formula:

Power (kW) = Energy (kWh) ÷ Time (hours)

we get:

450 kWh ÷ 0.083 h ≈ 5,400 kW, or 5.4 megawatts—per vehicle.

Assuming a nominal pack voltage of 400 volts (common for many EVs), the current required is staggering:

5,400,000 watts ÷ 400 volts = 13,500 amps

For perspective, the typical American home is wired for 100–200 amps total. One truck sucking up 13,500 amps is the equivalent of powering 70–135 homes through a single charging cable such as shown here. It would burn like a firecracker fuse.

Now plug in 20 trucks at once

5.4 MW × 20 = 108 megawatts of instantaneous draw 13,500 amps × 20 = 270,000 amps on tap

That’s roughly the average power demand of about 72,000 homes.

Now, extrapolate that sort of power demand across the US, and then the world?

Given the brute-force infrastructure needed to safely deliver that kind of juice, which would have to include super-cooled charging cables about as big around as a wine barrel, there’s zero chance this sort of scenario will become viable, maybe in our lifetime.

That said, those of you old enough may remember the skepticism about solving the “last mile” problem for video streaming. That paradigm shifted almost overnight. While this problem, call it the “last ten feet” problem, is far, far more complex, we humans are pretty good at problem-solving.

One solution, the battery swapping discussed earlier, already seems far more viable than completely rebuilding the world’s electrical infrastructure.

Why can’t a larger version of the battery in my laptop be used in EVs?

Lithium-polymer (Li-Po) batteries are the origami artists of the electro-chemical world—foldable, feather-light, and able to slip gracefully into the razor-thin confines of laptops, tablets, and racing drones. Their foil-pouch construction shaves off every surplus gram, allowing engineers to crease them into almost any flat silhouette. In a space-strapped gadget like a MacBook, that mix of high volumetric energy density and custom shapes is a design dream.

Shift the scene to an EV, though, and those origami skills hit their limits. EV packs must survive powerful charges—discharge sprints, constant vibrations, and the 200-kilowatt firehose of a fast charger—all without being damaged or overheating.

In a typical EV battery, cylindrical and prismatic cells are clad in rigid metal shells that wick heat away like built-in radiators; thin pouches, by contrast, trap warmth and can balloon when stressed. That ballooning alone disqualifies them for EVs. Furthermore, building a 60- or 100-kWh pack from MacBook-style pouches means stacking and wiring hundreds of delicate sheets—piling on cost, complexity, and potential failure points.

For small electronics, Li-Po are just the thing. For mass-market EVs—where every cent per kilowatt-hour and every extra degree of thermal headroom matter—tough cylindrical cells like Tesla’s 4680s and armored prismatic bricks rule the road.